Gift tax calculator

Taper relief only applies if the. This calculator is mainly intended for.

Irs Announces Higher Estate And Gift Tax Limits For 2020

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

. The rates range from 18 to 40 and the giver generally pays. Annual Gift Tax Exclusion. Federal Gift Tax Estimator This is a hypothetical example intended for illustration purposes only.

This page will be updated as more information becomes. The Estate Tax Calculator estimates federal estate tax due. Theres a simple formula to calculate the tax on a net gift.

At 475000 the gift was 150000 over the Inheritance Tax threshold. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Just like your federal income tax the gift tax is based on marginal tax brackets.

Gift tax tentative tax tax rate 1. If youre lucky enough and generous enough to use up your exclusions you may indeed have to pay the gift tax. Calculate the potential tax benefits associated with gifts of cash andor appreciated assets publicly traded securities closely held stock or real estate during your lifetime.

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. As it was given between 5-6 years before John died it. Gift tax calculator Calculator estimate how much gift tax you must pay The amount of gift tax is affected by the fair market value of the gift and the tax bracket of the.

Many states impose their own estate taxes but they tend to be less than the federal estate tax. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. And rates range between 18 and 40.

The tentative tax is the amount that would have been due if the gift hadnt been. Key Takeaways The gift tax is a tax on the transfer. How to Calculate the Gift Tax.

This means that any taxable amount exceeding the annual exclusion limit of 16000 per gift will be taxed at 18-40. Gifts given 3 to 7 years before your death are taxed on a sliding scale known as taper relief. This is the value of the gift for Inheritance Tax.

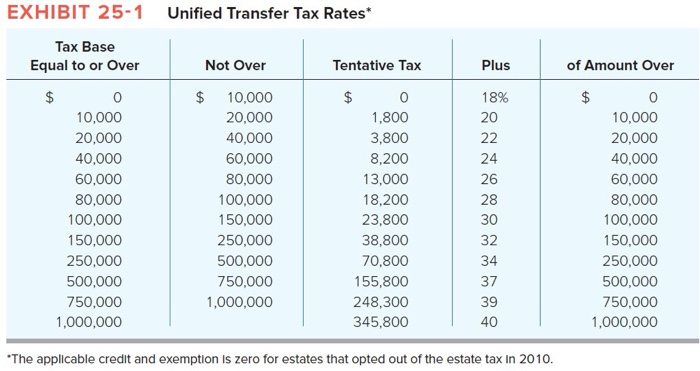

The first 10000 in taxable gifts is taxed at 18 the next 10000 is taxed at 20 the next 20000 is taxed at 22 and so on. If you want to. Calculate deductions tax savings and other benefitsinstantly.

This calculator calculates gift tax based upon the taxable gifts that you input. Gifting is a popular way to reduce inheritance tax liability. This calculator is designed to help you understand some of the key areas of gifting as a starting point to providing specific advice for.

This calculator estimates the federal income tax deduction for a donor s based. If their gift falls into more than one gift type category they can choose the gift type. To be tax deductible a donors gift must be covered by what we call a gift type.

Comprehensive Research Platform Accurate Time-saving Tools For PlanningCompliance. The tax applies whether or not the donor. In 2022 the annual gift tax exemption is.

In light of these changes the Connecticut Gift Tax Calculator should be used primarily for calculating historical results. Gifts given in the 3 years before your death are taxed at 40. Tax deductible gift types.

It does not show. The gift tax rate for 2022 is 18-40. Ad Get the Latest Federal Estate Gift Tax Developments.

The calculator below determines the charitable deduction for any of the following gift types. Gift Calculator Gift Calculator Use this free no-obligation tool to find the charitable gift thats right for you.

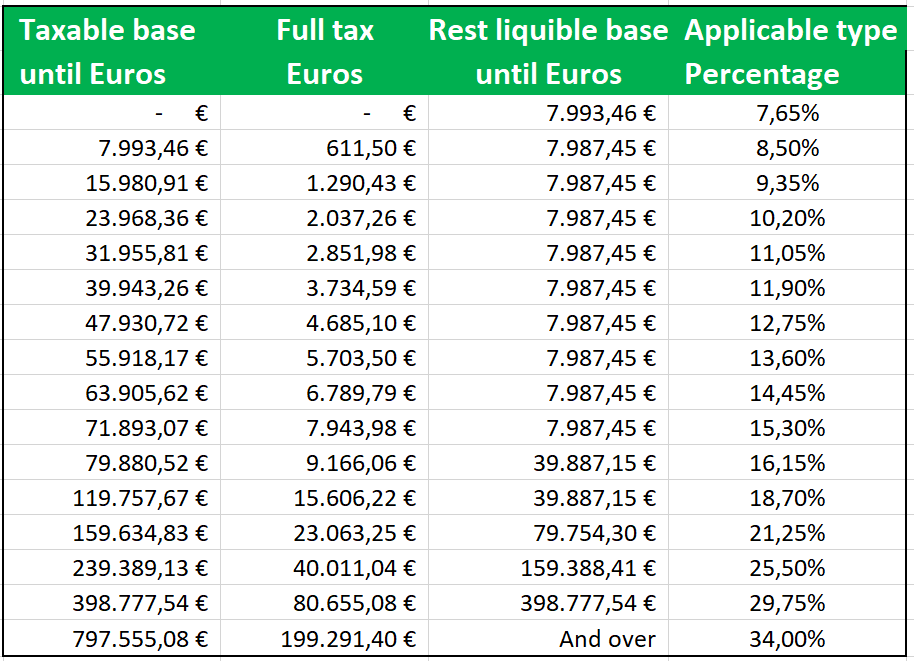

Spanish Inheritance Tax 2021 10 Things You Need To Know C D Solicitors

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

The Annual Gift Tax Exclusion H R Block

Tom Hruise Was An Entertainment Executive Who Had A Chegg Com

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Income Tax Formula Excel University

How To Download Ais Statement From Income Tax Portal Eztax

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Inheritance Tax Calculator 2018 Sondrassong Org

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Does The Gift Tax Work Personal Finance Club

Crypto Gift Tax Your Guide Koinly

Gift Tax Calculator Eztax

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Historical Estate Tax Exemption Amounts And Tax Rates 2022